Intelice Solutions: Blog

Dynamics NAV 2018 & 365 for Finance and Operations – 1099 Processing

If you need to process 1099s each year for your vendors, you can simplify and speed up the process by using Microsoft NAV 2018 and 365 for Finance and Operations. Once you go through the setup the systems it’s easy to process and produce your 1099s. Here we’ve provided an overview to get you started.

- The Vendor Setup Process

- 1099 Information Reporting

- How to Correct 1099 Data

- How to Run 1099s

MICROSOFT DYNAMICS NAV 2018

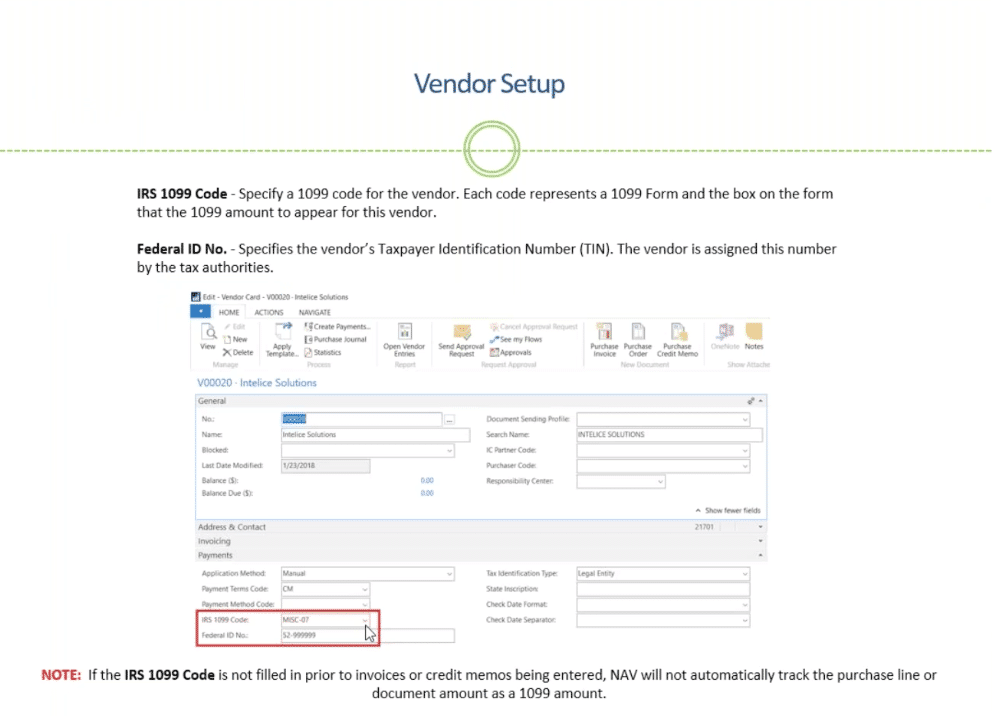

Vendor Setup

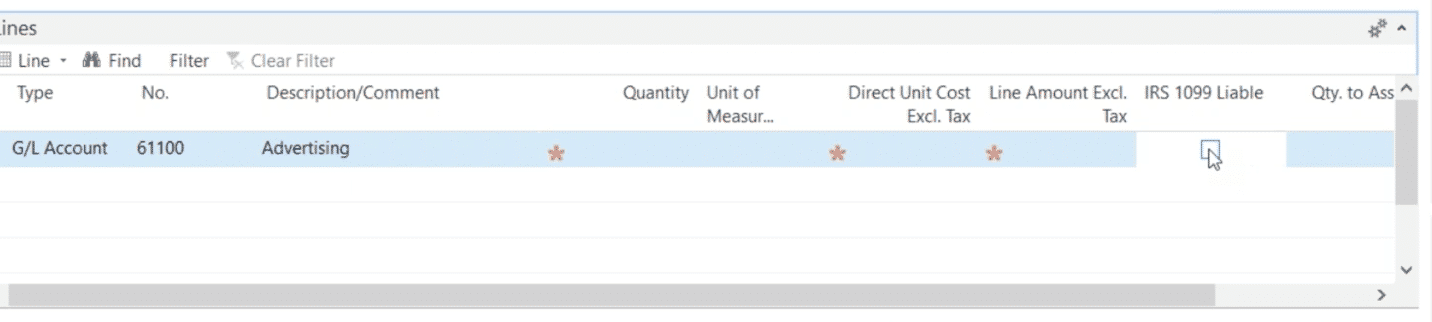

When you first set up a vendor on the Payments Tab there are a few fields that are critical to complete. The first is the IRS 1099 code. Even if you don’t have the W-4 information for your vendor, it’s good to set this up now with the appropriate code. When you enter invoices for this vendor, the code will automatically default on the invoices. The same applies with the field entitled 1099 liable that appears on each of the purchase lines. If it doesn’t apply, you can simply uncheck it.

uncheck or check as appropriate

The Federal ID number is also important to complete so it prints out on your 1099.

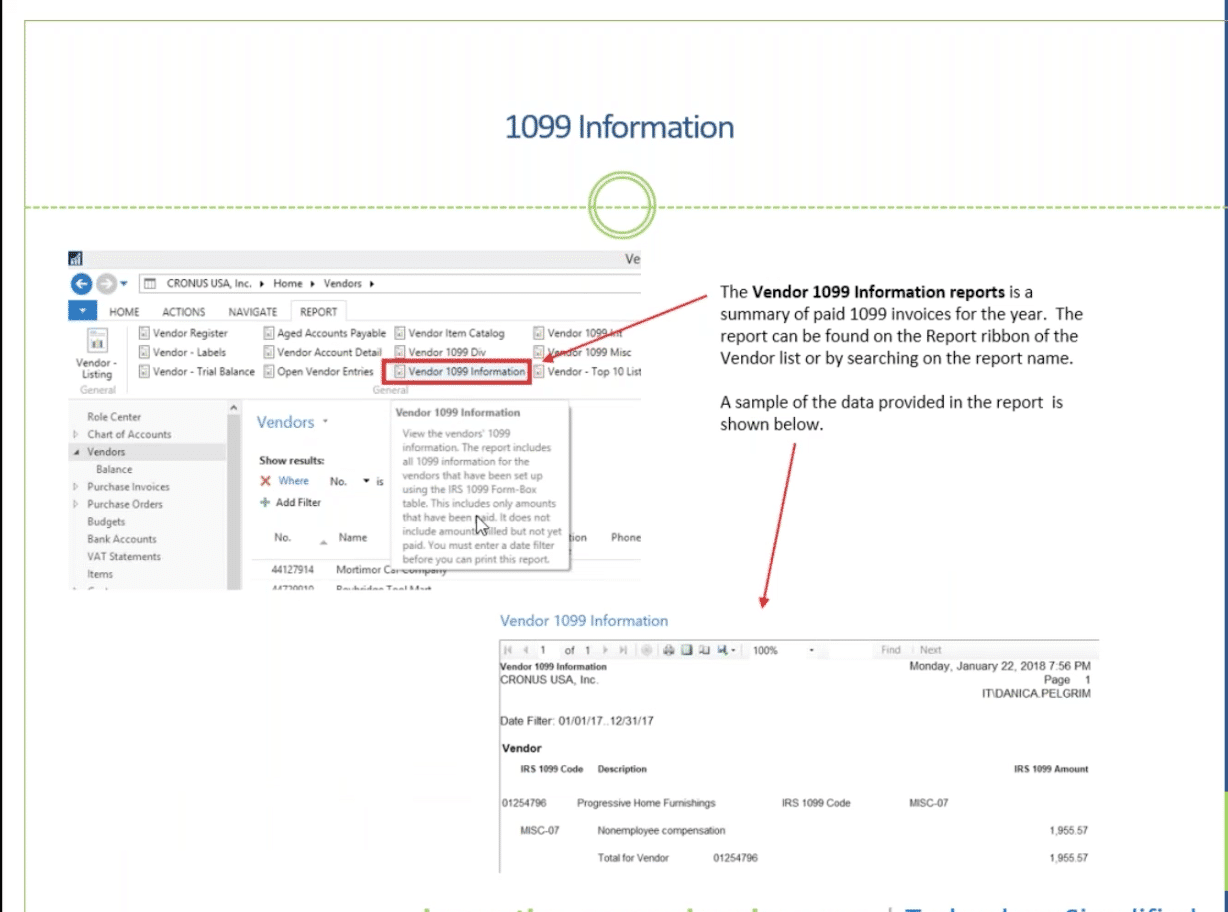

The 1099 Information Report

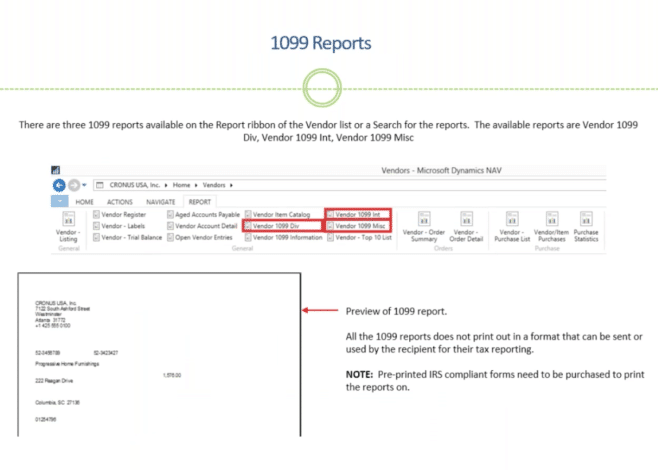

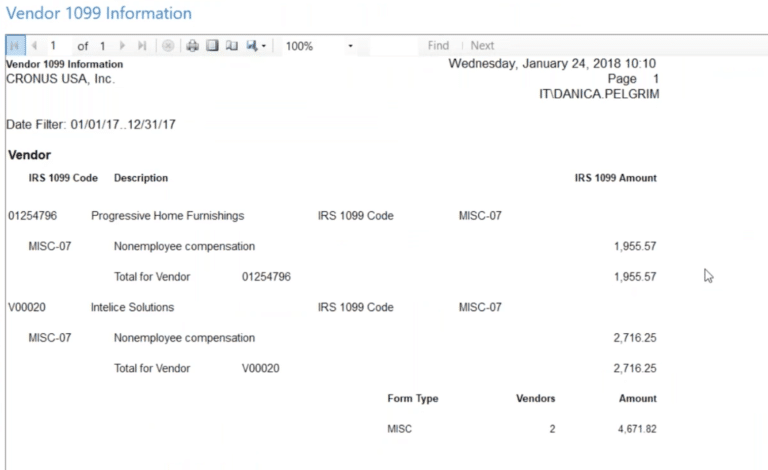

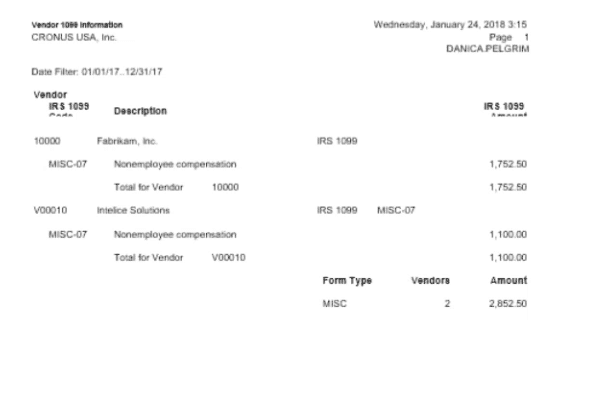

At the end of the year, you’ll want to produce a 1099 Information Report for each of your 1099 vendors before you print your documents. This way you can check the accuracy of your data. The Report will give you a list of any vendors you’ve invoiced over the year, along with the 1099 code you entered for each vendor.

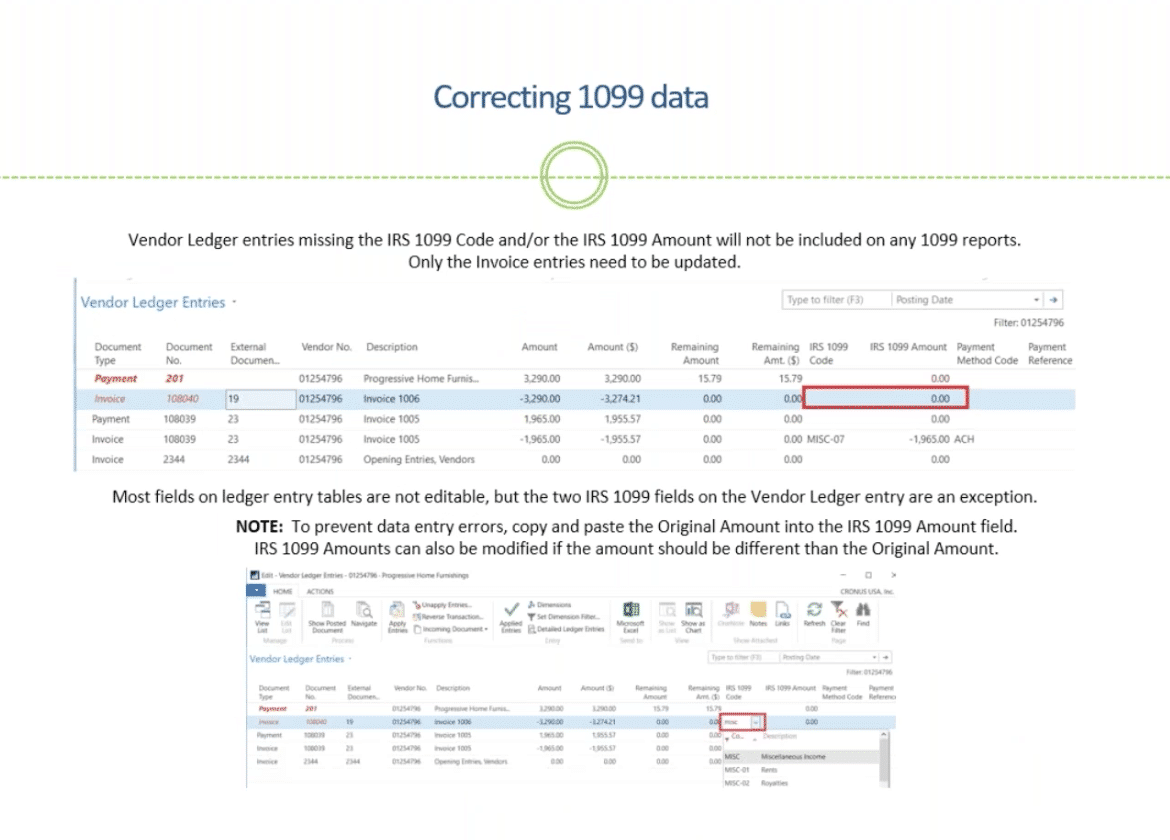

How to Correct 1099 Data

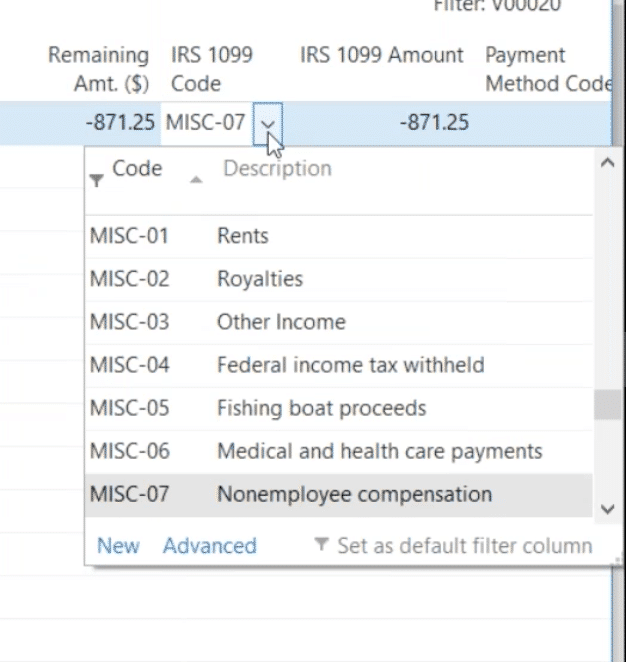

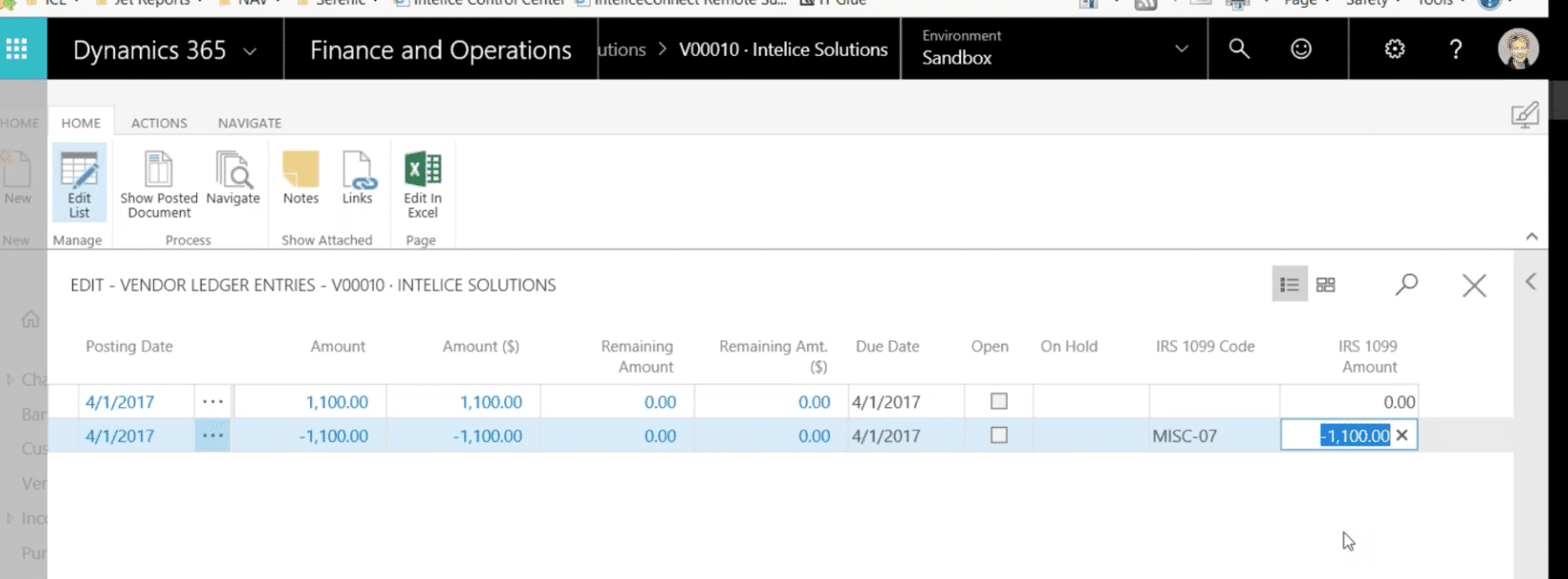

If you discover that you forgot to enter a code for a vendor, you can fix this in the Vendor Ledger. Select the ledger for the particular vendor you need to input the code for. Be sure to change/enter the information on the Invoice line, not the Payment line. If you see that the IRS 1099 Code is blank, you should correct this now. There are very few lines that are editable, but this is one of them. You’ll also want to enter the correct number in the IRS 1099 Amount if it isn’t there.

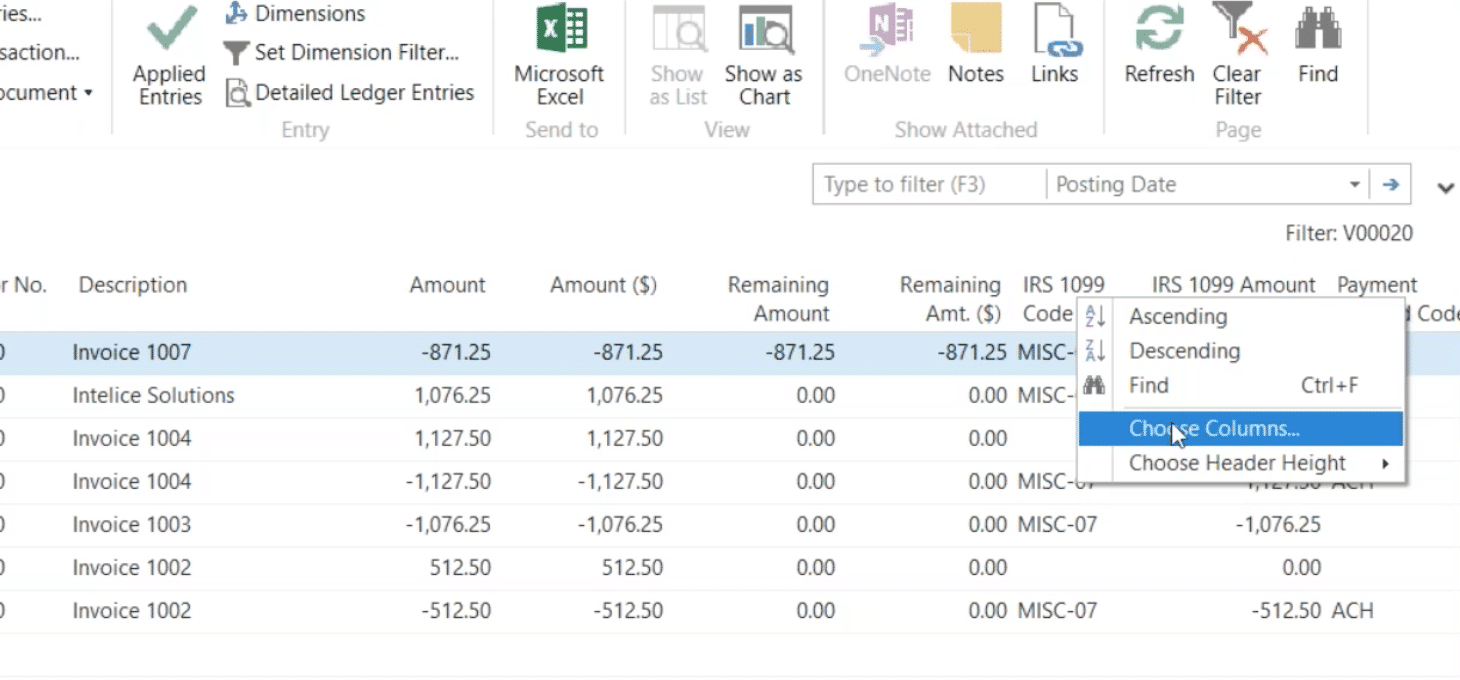

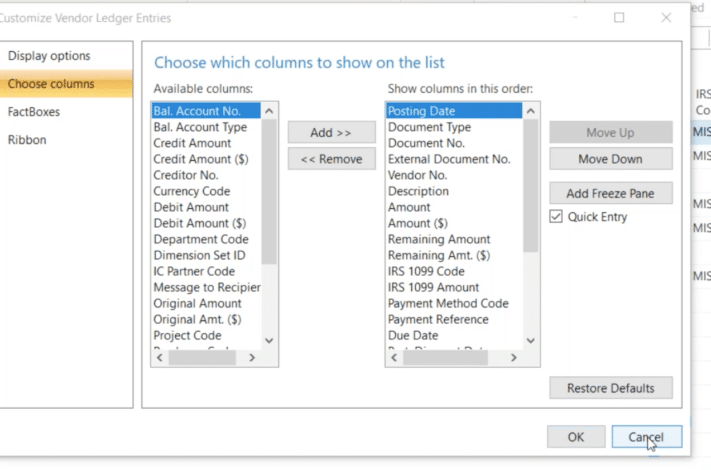

Under Ledger Entries, if you don’t see your 1099 code here, go to Choose Columns to select what’s appropriate.

Once the data populates, you can further manage it with the drop-down menu. If the amount isn’t right, you can manually change it here.

How to Run 1099s

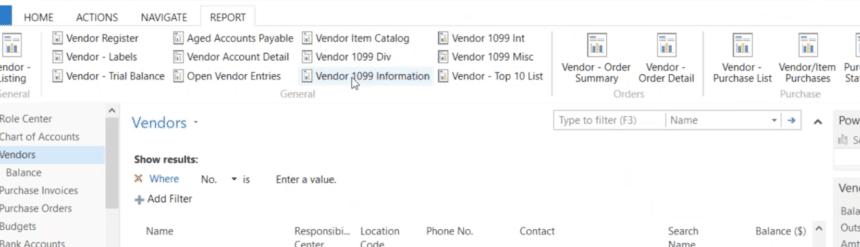

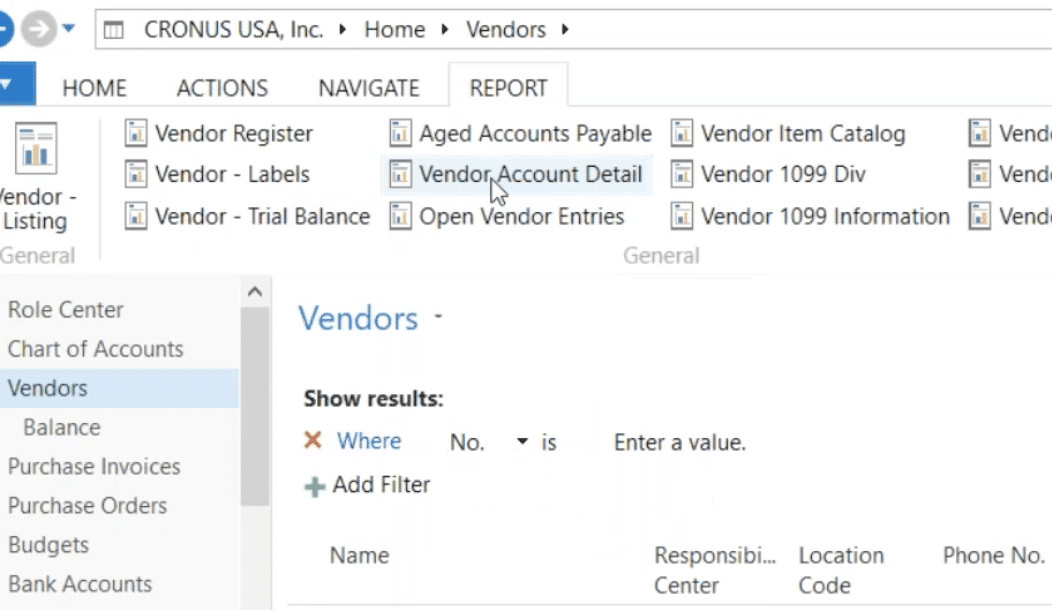

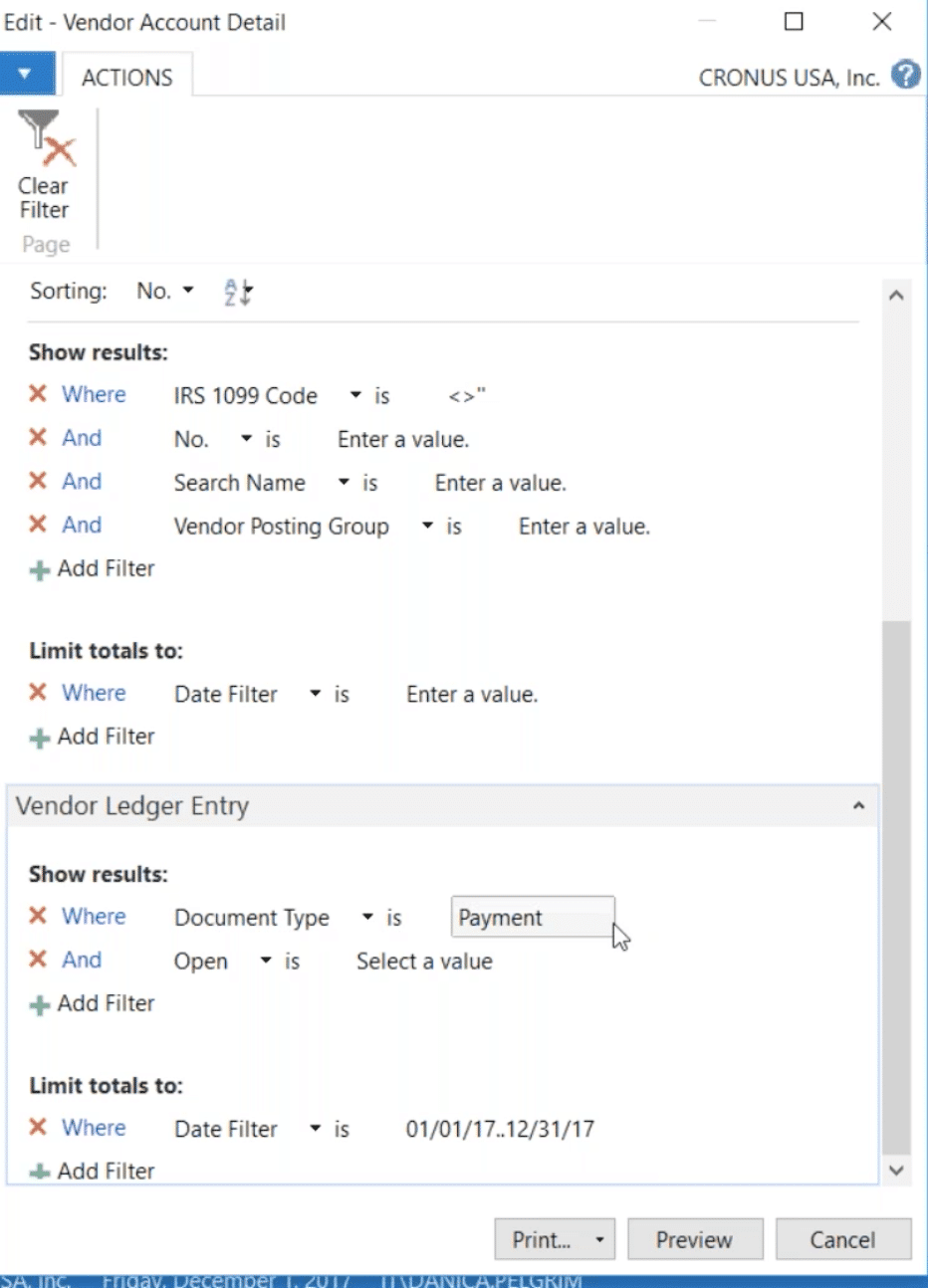

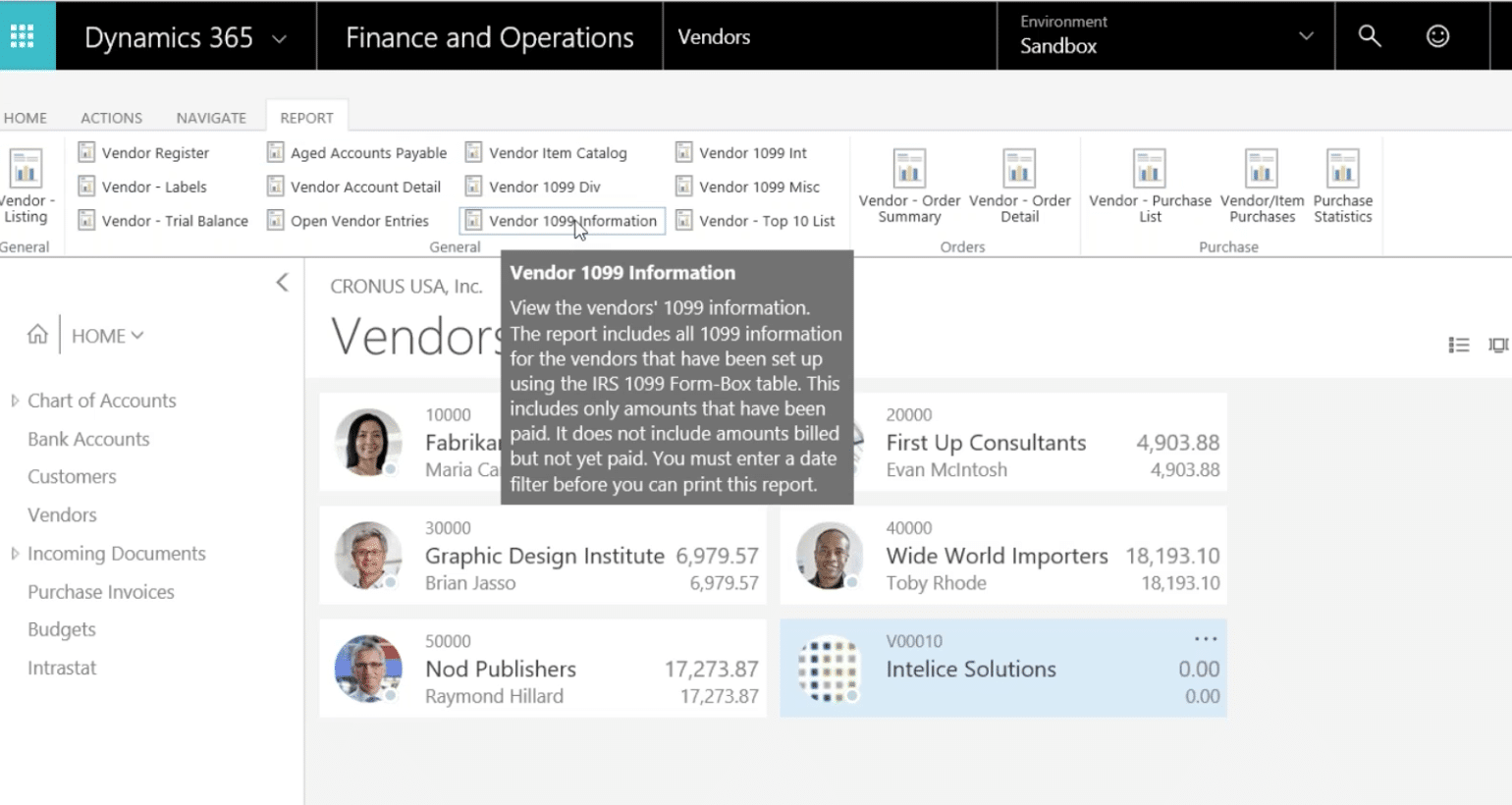

Once you’ve corrected the information on your vendor ledger entries, you’ll find the reports to run on the Report tab of your Vendor List. Instead of running all your vendor reports at once, try running just a few to ensure everything has been set up properly and that the information is aligned as you wish. (You may need help with this. If so, contact whoever provided the NAV program for you.)

In your Report List you’ll find a tab for your Vendor 1099 Information where you can choose a vendor to see the specific information you’ve entered.

You can also go to the Vendor Account Retail Report to check for reasonableness, and to make sure the amount of payments you made to the vendor appear accurately in your 1099 Information Report.

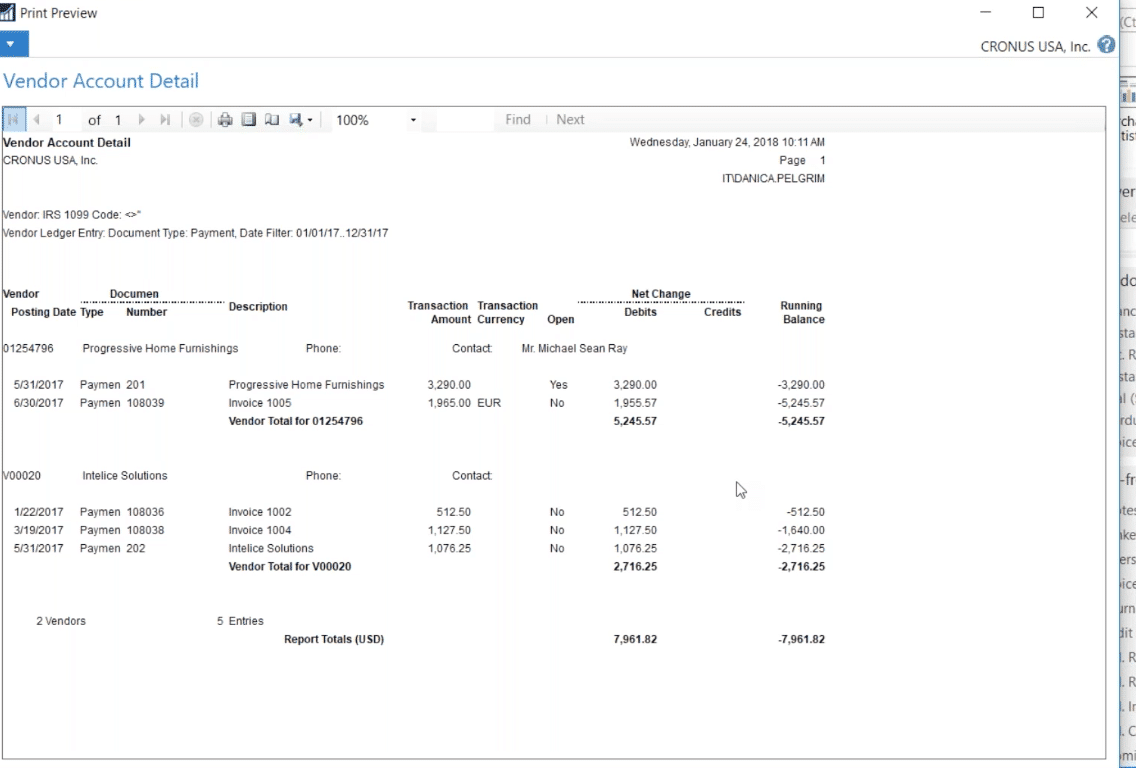

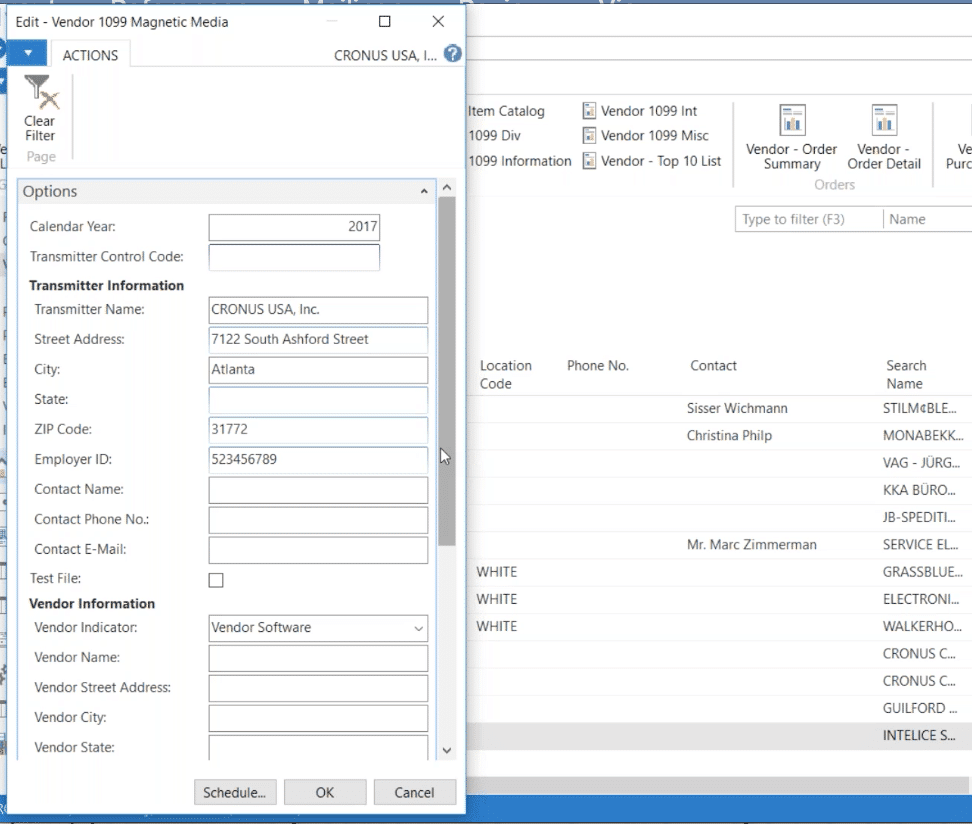

Vendor Magnet Media

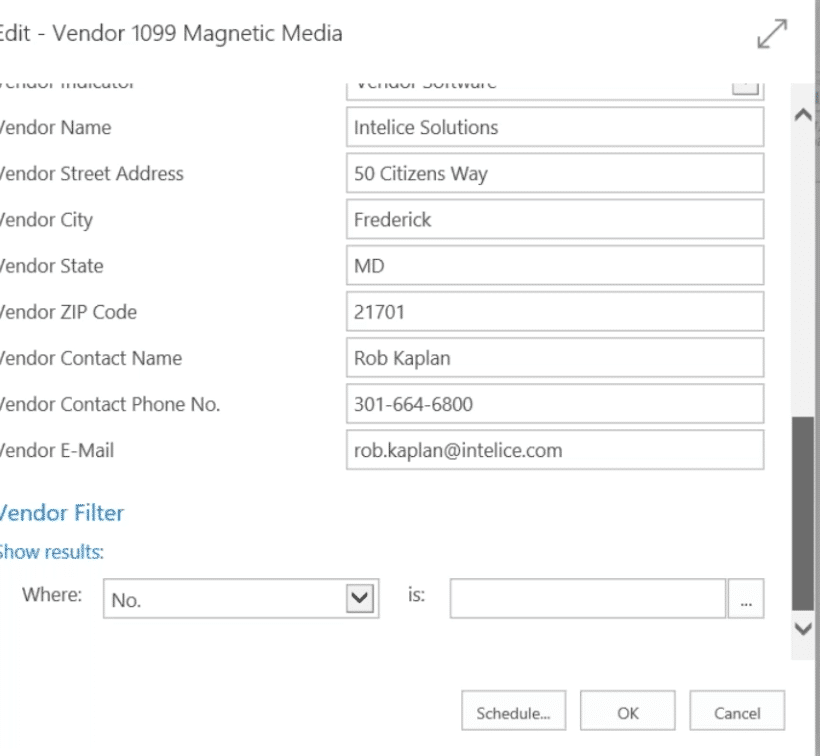

Once you’ve run your Vendor Reports, the final step is to run your 1099 Magnetic Media. You’ll send this report to the IRS. Ensure the Federal ID number for each vendor is populated in this report. You can find it under the Company Information tab. All this information should populate the report. The name of your company and contact info will be printed at the top of the Report. Make sure your unique Transmitter Control Code is also provided here. The IRS can provide this number for you if you don’t have one. At the bottom of the report is the Vendor Information for the company that provided the NAV 2018 for you. Be sure all of this information is completed.

Now you can enter your Magnetic Media Control Number and other company information that didn’t display as required. This is also where you need to put in the IRS Transmitter Control Number if it’s not here. You can manually enter additional information in these field if needed. If these fields aren’t completed properly, you’ll get an error message. Once complete, hit okay and a text file will appear that you can upload to the IRS.

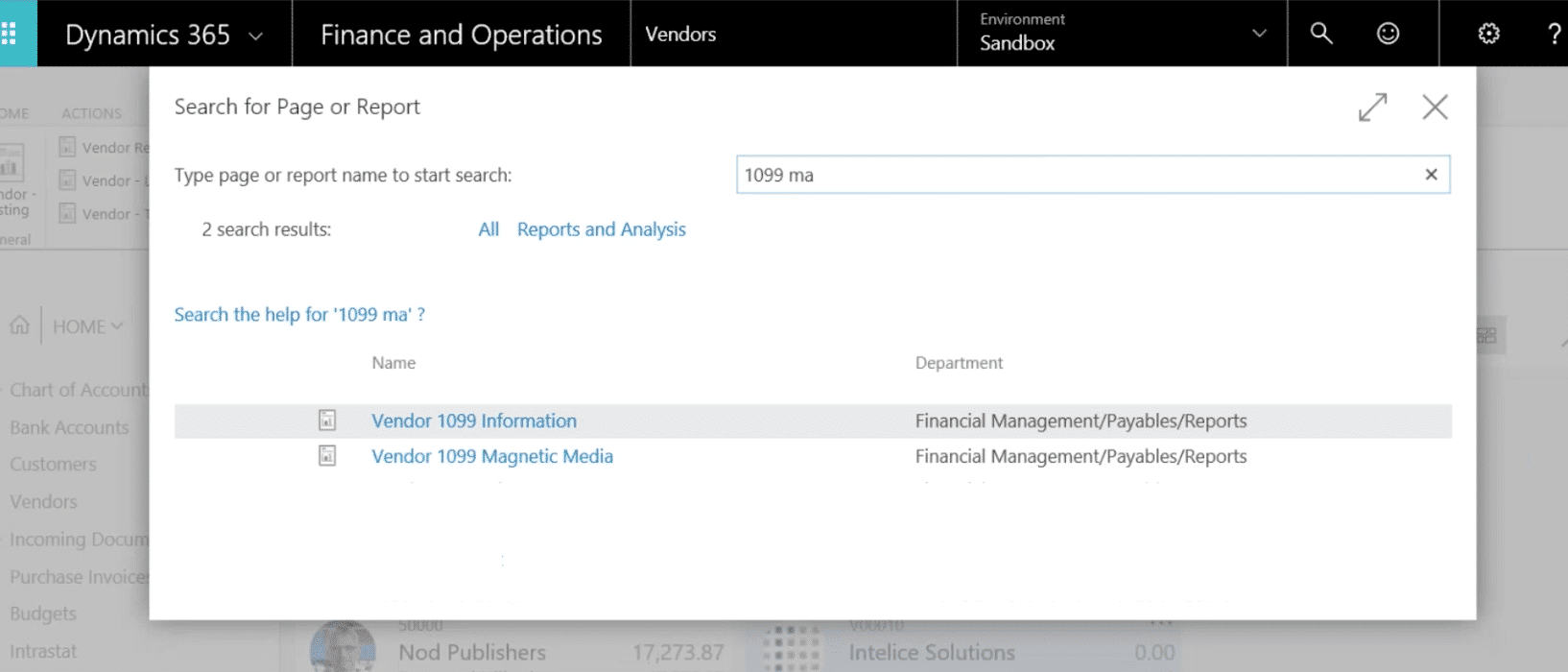

MICROSOFT DYNAMICS 365

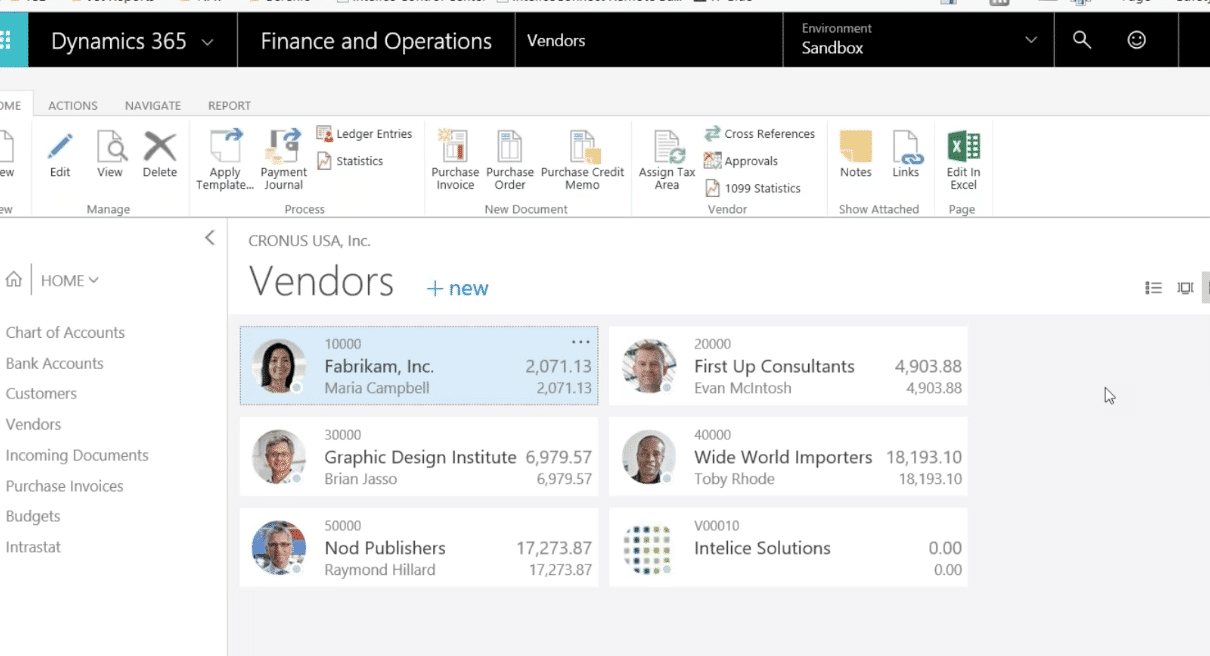

The process is very similar in Dynamics 365 to your desktop Dynamics NAV. However, it looks a bit different. Here you see that you can get a tile view of your vendors.

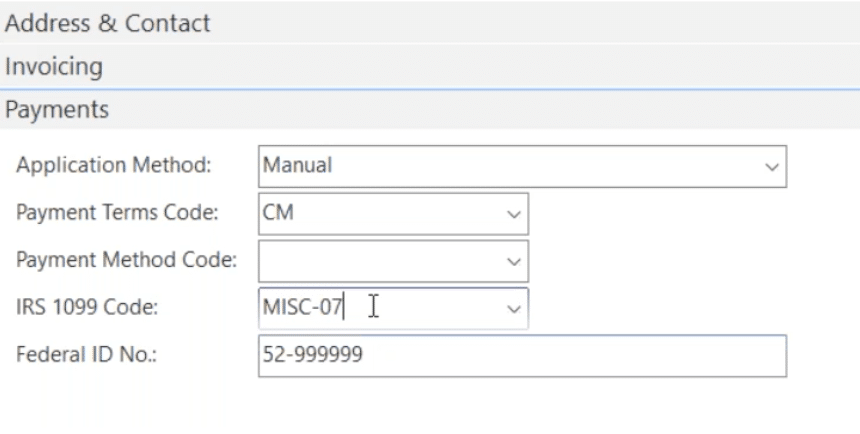

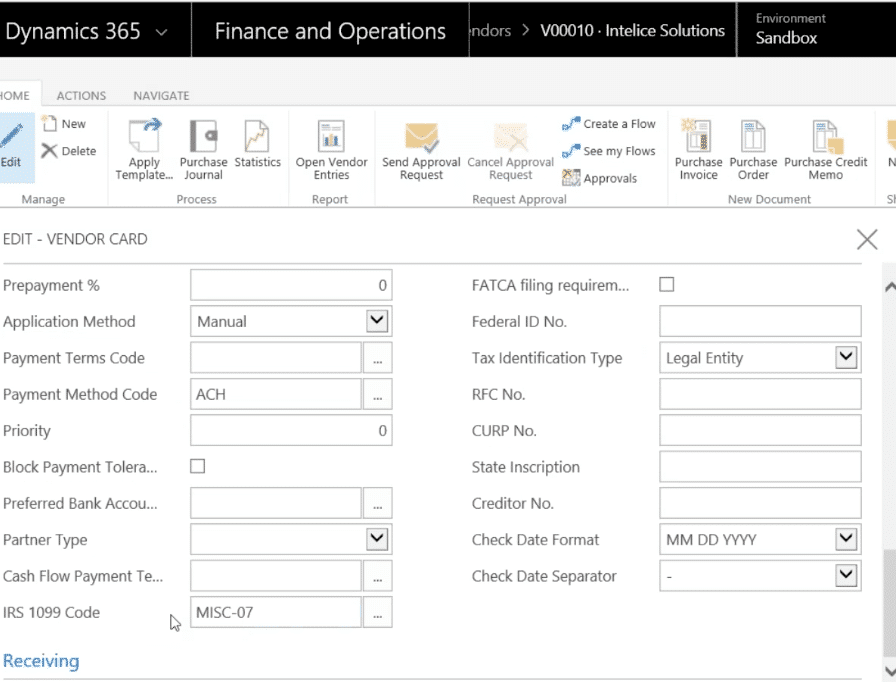

Just like you did in NAV, you enter the appropriate information in these fields in 365. Make sure your Vendor Liable field is complete.

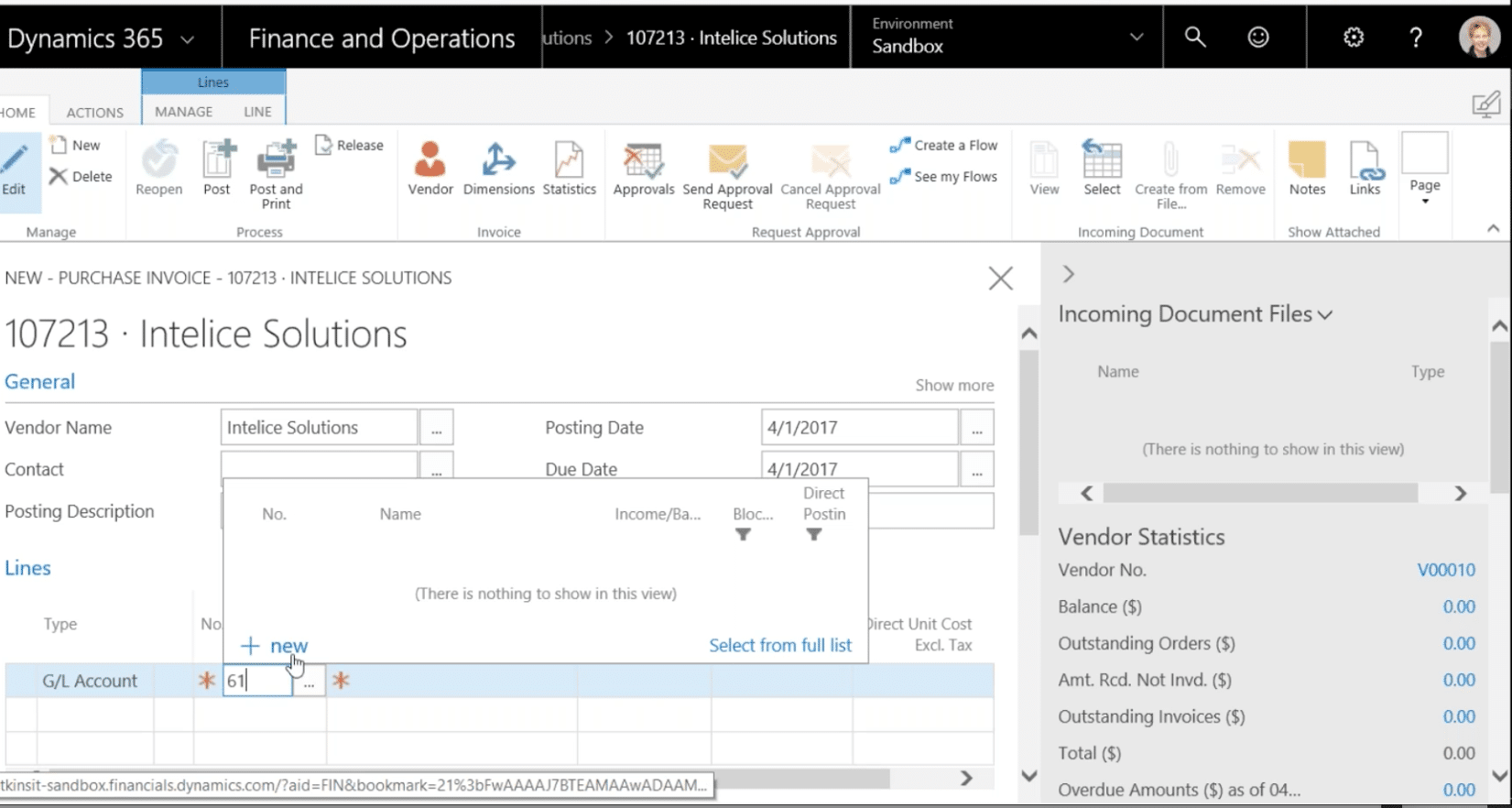

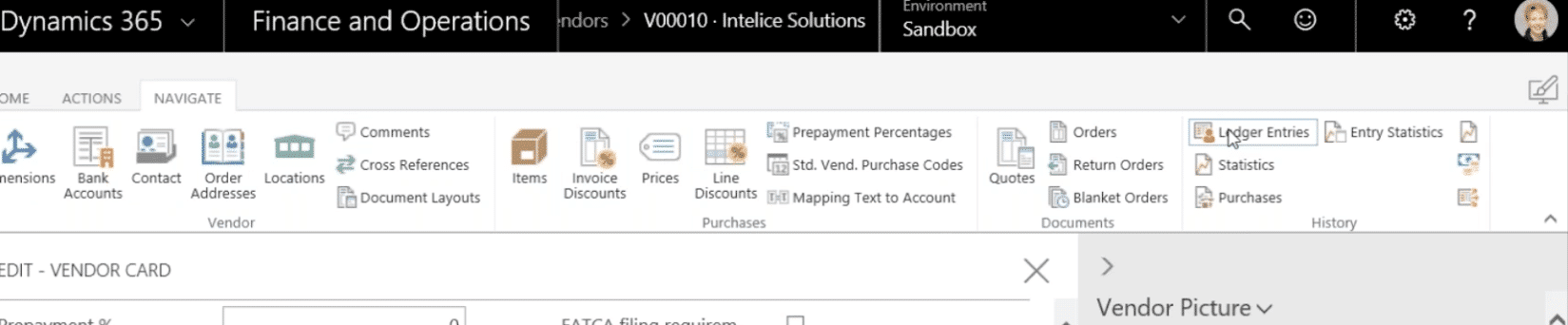

To make any corrections, just like you did in Dynamics NAV, go to Ledger Entries.

NOTE: When posting payment amounts, make sure the corresponding negative amount appears in your IRS 1099 amount. On your credit memos this amount would be a positive sign. Make sure your credit memos also contain the correct code.

Your 1099 Information Report will be in the same place as it was in Dynamics NAV, and the process and reports are the same as well.

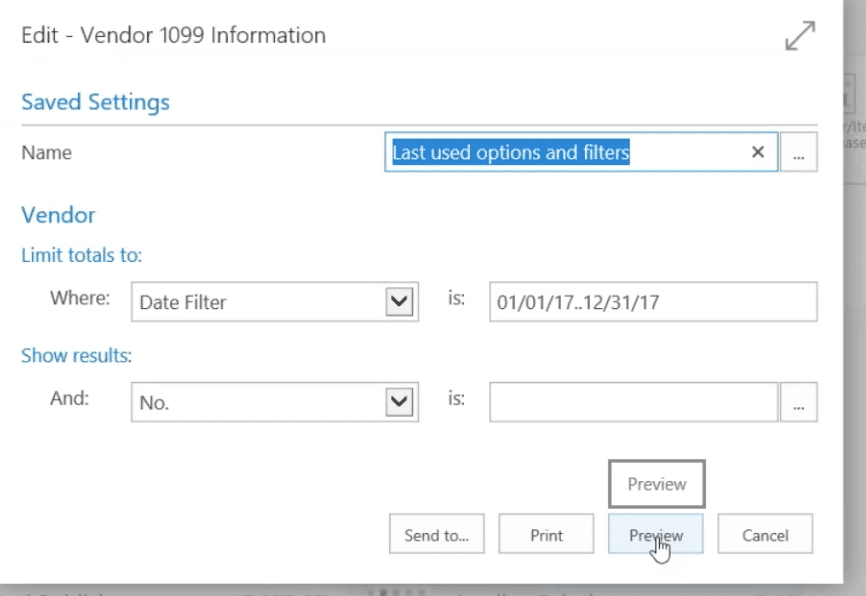

Run your 1099 and make sure you input the appropriate date filters.

Your preview report should look exactly like it did in Dynamics NAV desktop version.

Make sure your reports all lineup, do a search for 1099 Magnetic Media under your Vendor 1099 Information.

And, make sure it contains all the appropriate information.

Hit OK and create the file to upload to the IRS. You’re done!

In summary, here are some Helpful Hints to remember:

- Set up your Vendors with a 1099 properly before creating entries or transactions.

- Show the 1099 Liable box on purchase lines to manage amounts to include on your 1099s.

- Run the 1099 Information Report before running your 1099s to check for reasonableness.

Need Help? For more information contact: