Intelice Solutions: Blog

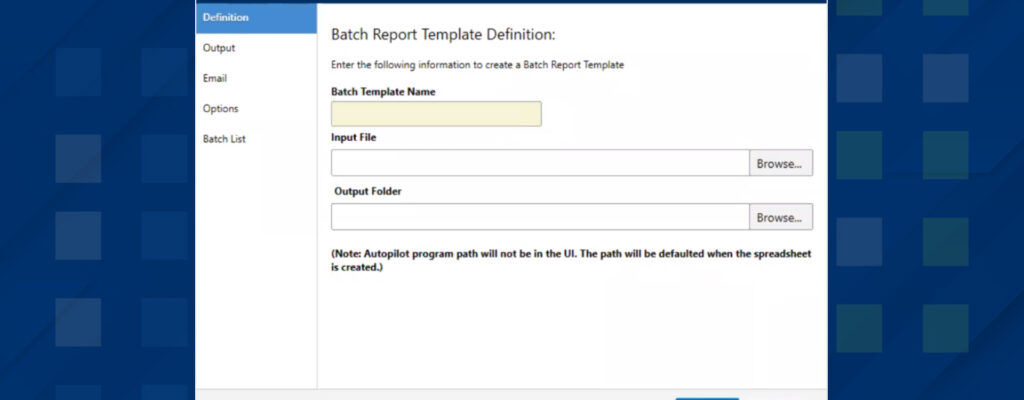

What’s New in Jet Reports 21.4?

Jet is intended to help CFOs track and understand key data in their organization.

Read MoreTime Required To Setup Microsoft Dynamics 365

Time Required To Setup Microsoft Dynamics 365 Businesses have always dreamt of how they could transform enterprise resource planning (ERP) and customer relationship management (CRM) into a single, easy-to-use management system. Microsoft Dynamics 365 is a cloud-based ERP and CRM…

Read MoreWhy Businesses Need Access to Up-to-Date, Real-Time Analytics

Real-time analytics is the process of collecting live data, processing it instantaneously, and using it to inform or guide business decisions.

Read MoreWhy Businesses Need Access to Up-to-Date, Real-Time Analytics

Real-time analytics is the process of collecting live data, processing it instantaneously, and using it to inform or guide business decisions.

Read MoreMajor Differences Between Microsoft Dynamics 365 and Microsoft Dynamics NAV

What Are the Major Differences Between Microsoft Dynamics 365 and Microsoft Dynamics NAV? With Microsoft having a massive line of products, it is often a challenge to choose the best tool to settle for when wanting to accomplish certain business…

Read MoreMajor Differences Between Microsoft Dynamics 365 and Microsoft Dynamics NAV

What Are the Major Differences Between Microsoft Dynamics 365 and Microsoft Dynamics NAV? With Microsoft having a massive line of products, it is often a challenge to choose the best tool to settle for when wanting to accomplish certain business…

Read MoreJet Analytics Improves Business Strategy

Reporting and analytics are key parts of informed business strategy. Without a detailed understanding of how your business operates and how it performs, how can you expect to make any meaningful improvement?

Read MoreSales and Marketing Automation with Microsoft Dynamics 365

With marketing automation, you will be able to fully leverage the potential of marketing. Marketing automation enables companies to automate even the most complex marketing tasks.

Read MoreMicrosoft Dynamics 365 For Finance and Operations

Intelice Solutions provides support for Microsoft Dynamics solutions in Washington DC.

Read More

Microsoft ERP Branding

A Quick & Easy Guide

Unsure what the difference is between Dynamics NAV and Dynamics CRM? Check out this guide to make sure you’re considering the right Microsoft business application for your organization.

Read MoreRecent Posts

How can we help?

Whether you need immediate help with an IT issue or want to discuss your long-term IT strategy, our team is here to help.

Call us at (301) 579-8066 or complete the form below and we'll help in any way we can.

"*" indicates required fields

Categories

- 2020's Rewrites

- Advanced Cybersecurity

- Blog

- Company News

- Compliance Articles

- COVID19

- Cybersecurity Alerts

- Cybersecurity Awareness Month – 2022

- Cybersecurity Insights

- Cybersecurity News

- Financial Management Systems

- Financial Management Systems

- Financial Management Systems ERP Solutions Articles

- General Business Insights

- Industry News

- Industry Reports

- Intelice Case Studies

- Intelice News & PR

- Intelice News & PR

- Intelice's Solution

- IT Services In Washington DC Metro

- Managed IT Services Articles

- Managed Security

- Meet The Team

- Microsoft 365

- Microsoft Business Central

- Microsoft Office

- Microsoft Teams

- Microsoft Tips & Tricks

- News

- Newsletter

- Optimize Blog

- Our Partners

- Tech Tips

- Technology Education & Information

- Testimonials

- Video Library

- Webinar Replay